Online loans, fast money services, or money lending apps In a time when goods are becoming more and more expensive, it’s likely become a popular option. On the other hand, income and asset interest rates fell. to locate funds during periods of inflation and belt-tightening such as these.

You may find eight money lending applications that have been updated for 2022–2023 in this post. All of the apps included here are legitimate online money lending applications that enable users to borrow money. Crucially, the suppliers Each service is created and maintained by reputable financial organizations and banks. Which loan applications are worth using, let’s see.Note: Loan services are not offered via the Zipmex application. This article’s material was compiled from many apps just for the readers’ knowledge.

Money Loan App 1 : Money Tid Lor

When most individuals think of legal internet loans, their first thought undoubtedly goes to Ngern Tid Lor. It provides lending services to owners of many types of vehicles, such as trucks, trade trucks, motorbikes, sedans, and pickup trucks. Including offering a range of services related to vehicle insurance. Furthermore, one of Ngern Tid Lor Company’s shareholders is Bank of Ayudhya. The intriguing part about the lending business, aside from its affiliation with MUFG, is that it offers a large credit limit and instantaneous receipt of a lump sum payment. It is not necessary to have a guarantee. Including up to sixty months’ worth of payments.

- 100,000 Baht is the maximum credit limit (not including refinancing).

- Interest rate: 0.79% monthly

- Time of approval: instantaneous or maximum of two days

- a condition

- age range of 21 to 60

- experience working for six months or longer

- drive a car if you’re younger than 18

Money loan app 2: Krungsri iFIN

Regulating body/service provider: Ngern Tid Lor Public Company Limited krungsri iFIN is a platform for personal loans. The KMA-Krungsri application allows users to apply for loans by simply uploading the required documentation using their cellphones. facilitates easy and rapid loan availability. If it is accepted, you will be given an installment loan, which is a lump sum that is deposited into your account and has interest that must be repaid at a certain rate.

- 2 million Baht is the maximum credit limit, or no more than five times your annual salary.

- Interest rates are 3% annually.

- Time of approval: one day

- a condition

- 20–59 years of age

- possess revenue that meets the requirements of the bank

- One year or more of employment or business experience since registration

- Bank of Ayudhya Public Company Limited is a regulatory body and service provid

Money loan app 3: Dolfinmoney

Dolfinmoney is regarded as an online loan provider that facilitates a more convenient experience for users. Since the Dolfinmoney loan app is intended to function as a personal loan in the guise of a virtual card, it enables users to carry about additional cash. Make it simple for your hand to rotate. By removing work with ease Through the Kasikorn Bank ATMs or the K Plus app Furthermore, in the event that no significant credit lines are used, interest is not paid. In business hours, the quickest time to wait for approval is five minutes after submitting a request.

- Credit limit at maximum: five times your salary

- Interest: No more than 25% annually

- Time of approval: 5 minutes; requirements: 21–70 years old

- Send in a payslip that is no older than three months.

- Service provider/regulatory organization: Kasikorn Bank Company Limited

Money loan app 4: Xpress Loan

Another rapid lending option is Xpress lending, an online loan application provided by Kasikorn Bank. Xpress Loan differs in that it prioritizes simple borrowing and speedy loan approval. It is, in essence, a choice for people in need of an urgent loan. Furthermore, the use of securities or personal guarantors is not required. Apply via the K Plus application (latest updated version) with just one national ID card. Crucially, it is a lending business that enables loan applications from those making less than $10,000 annually.

- Credit limit at maximum: five times your salary

- Interest: least 17% annually

- 15-day approval period

- condition: 20–70 years of age

- own a minimum of 7,500 baht or more in monthly income

- Working for a minimum of six months

- Age of business not less than one year

Loan App 5 : Finnix

Kasikorn Bank Company Limited is the regulatory body and service provider.

Those trying to find a money lending app Quick money, legally, in 30 minutes. Finnix, which offers legal loans in five minutes, could be visible to you. A financial instrument similar to a loan, Finnix is offered by Munniks Company, a division of Siam Commercial Bank. Pay attention to big credit lines, quick approvals, and simple loans. Above all, loans are available to independent contractors and self-employed individuals. since a wage slip is not required to be submitted However, take into account any additional data that the client agrees to give the authorities.

- Credit limit maximum: 100,000 Baht

- Interest rate: 2.75% monthly

- Time of approval: five minutes; requirements: age of twenty to sixty

- income of at least 8,000 baht each month

- Siam Commercial Bank Public Company Limited is the regulatory body and service provider.

Money Loan App 6 : Money instantly

Another reputable online money lending provider is Thander Money. because the Bank of Thailand is in charge of it. Additionally, it is a cooperative project and service offered by the Siam Commercial Bank Group’s SCB Abacus Company Limited. It may take borrowers up to 15 months to pay back the loan. Without any vacations, no deposits, and no additional costs, they may apply for the loan whenever they choose.

- Credit limit maximum: 50,000 Baht

- Interest rate: 2.75% monthly

- 24-hour timeframe for approval.

- Conditions: 20–65 years of age.

- Regulatory body/service supplier: Abacus Company Limited and Bank of Thailand

Money Loan App 7: Turbo Money

By Money Turbo offering services for loans or fast loans. Accept and be paid right away includes both collateral-requiring and non-collateral-requiring loan types. This may be examined in more detail based on the specifics of any kind of financial product. In addition, the maximum installment payment term is 84 months, and the interest rate is rather low in comparison to other legitimate online lenders.

The most recent partnership between Turbo Money and Kasikorn Bank involves KBank acquiring 10% of the company’s shares and expecting to turn a return on the loan portfolio by 2023.

- Credit limit maximum: Specifics vary based on product type.

- 0.68% of interest

- Time of approval: 24 hours.

- Age range: 20 to 70 years.

- Ngern Turbo Company Limited is a service provider and regulatory body.

Money loan app 8: Money Hub

Small company owners or entrepreneurs seeking access to funding without having to wait for approval to submit a loan application on your own to a bank or other financial institution. The Money Hub program allows you to apply for a loan. These services are offered by Money Hub via a product known as “Good Person Loan.” The best thing about using this app to apply for a loan is that it’s simple to do at any time or place. All that is required is a 15,000 baht minimum income; there are no further costs. include interest payments for a maximum of twelve months.

- Credit limit maximum: 50,000 Baht

- Interest rate: 2.75% monthly

- Time of approval: 24 hours.

- Conditions: 20–58 years of age.

Thai Foods Group Public Company Limited is the parent company of Money Hub Service Company Limited, a regulatory body and service provider.

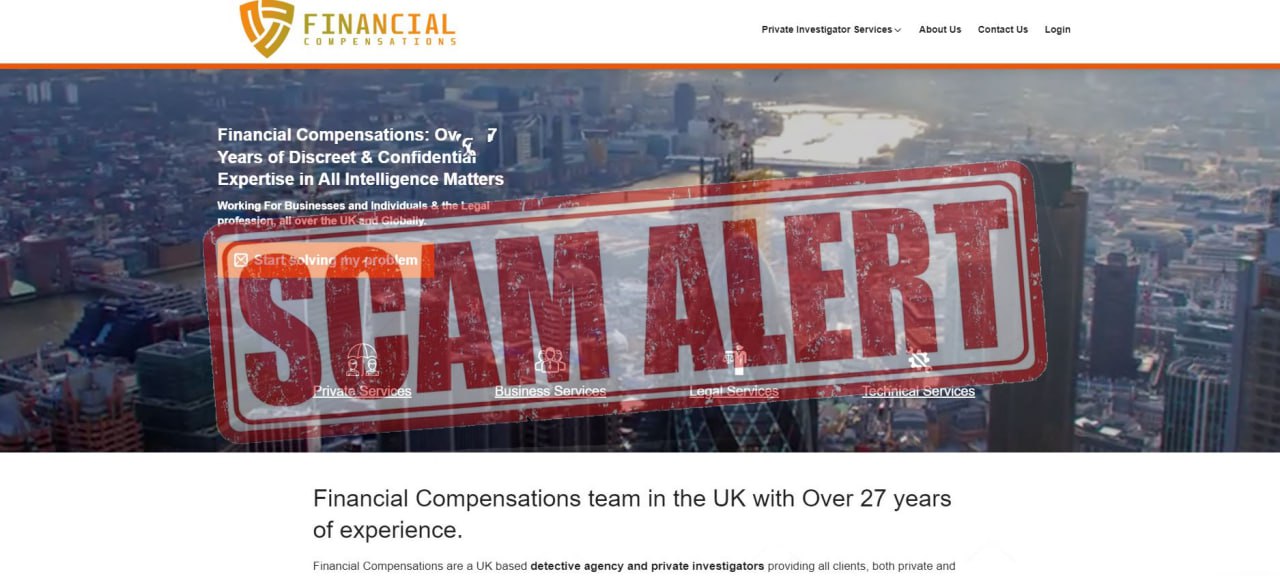

How to identify applications that lend money illegally

It’s important to be aware of both legal and illicit sources for borrowing money in addition to knowing where to obtain a loan. This might trick applicants into spending money they don’t have. The most crucial thing is to research or investigate loan apps or other lending services to determine whether or not a reputable bank or financial institution is in charge of them. You may also go into the loan service organization’s owner’s previous records.

- Furthermore, there are a few techniques to determine if those lending services are legitimate or fake. Including the use of these techniques

- Check whether anything odd appears in your message or contact details.

- To find out basic information and verify the company’s existence, search for the name of the business or other details like registration numbers.

- Look for phone numbers that are associated with that company and compare them to make sure they are the same.

Watch out for rewarding and profitable misinformation. interest rate or too substantial advantages

This is a compilation of the lawful money lending applications for the years 2022–2023. However, employing urgent money services is really one way to get cash quickly. There are, in fact, alternative options. Growth options for the available balance are numerous. which can be selected based on their own rules as suitable. Whether it’s using your own method of investing during the recession, conserving money, investing in gold, or earning money based on your skill level via money-making applications. Naturally, all of this There are methods for getting money right away. or need to wait for the ideal opportunity yet get long-term benefits? Depending on the type of outcome you’re after.

Caution

This article’s material was assembled from a number of trustworthy financial sources. to exclusively impart fundamental information to the broader population. But there is risk associated with every investment. As a result, investors have to research and comprehend asset qualities. Conditions for returns and the asset’s dangers Including weighing the risks before making an investment decision.