In a significant crackdown on financial fraud within the online trading and cryptocurrency sectors, authorities across Europe have exposed the deceptive practices of four major entities: Financial Compensations, ROI-FX, 72 Option, and EuropeFX. These organizations, operating under the guise of legitimate financial service providers, have been implicated in extensive fraudulent activities, deceiving investors and eroding trust in digital financial markets.

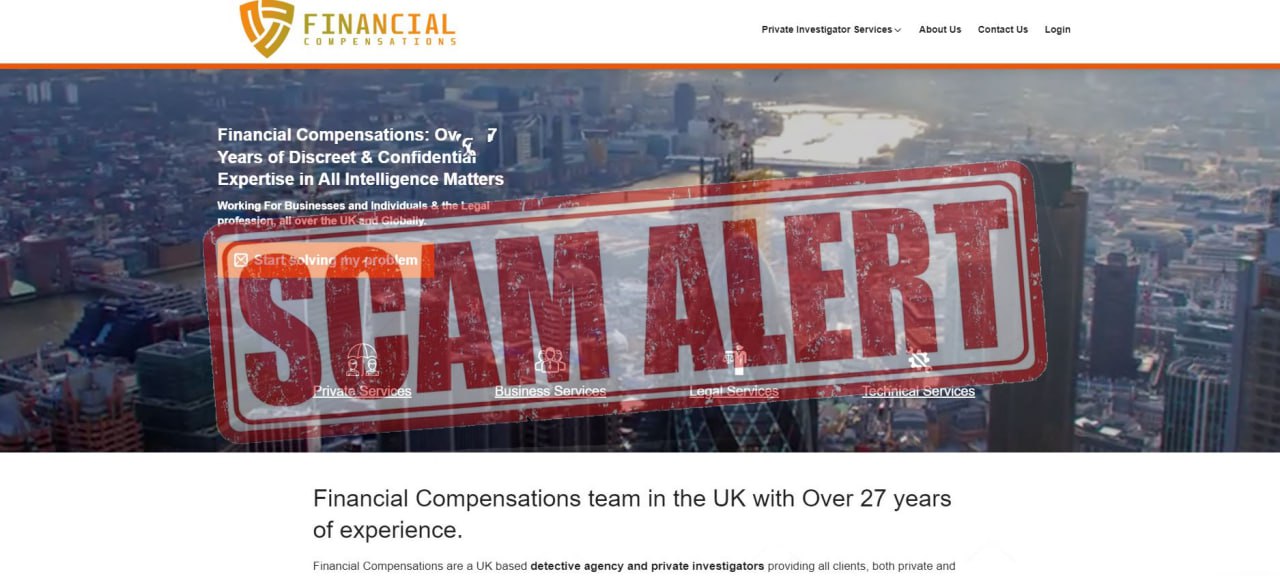

The Unraveling of Financial Compensations

Financial Compensations presented itself as a reputable firm specializing in recovering lost funds for investors who had fallen victim to online trading scams. Promising victims substantial reimbursements, the company lured investors with assurances of their expertise and connections within financial regulatory bodies. However, investigations revealed a disturbing reality: instead of aiding victims, Financial Compensations exploited their desperation, charging exorbitant fees upfront without delivering any tangible results.

European regulators, in collaboration with law enforcement agencies, uncovered a complex web of deceit involving falsified documents, non-existent recovery processes, and aggressive solicitation tactics. Victims were often coerced into paying additional fees for services that were never rendered, exacerbating their financial losses.

ROI-FX, 72 Option, and EuropeFX: Facades of High Returns

ROI-FX, 72 Option, and EuropeFX operated under the allure of high returns on investments in online trading and cryptocurrency markets. Advertising themselves as sophisticated platforms with advanced trading algorithms, these companies attracted a substantial number of investors seeking lucrative opportunities in the burgeoning digital asset space. Promising exceptional returns with minimal risk, the platforms quickly amassed significant user bases.

However, the veneer of legitimacy began to crack when investors encountered difficulties withdrawing their funds. Subsequent investigations by financial authorities revealed that ROI-FX, 72 Option, and EuropeFX were, in fact, fraudulent operations. New investors’ funds were used to pay returns to earlier investors, creating an illusion of profitability. When the influx of new investments slowed, the schemes collapsed, leaving countless investors with significant losses.

Frozen Assets and Partial Restitution

In the wake of these revelations, authorities have frozen assets worth approximately 71 million euros linked to Financial Compensations, ROI-FX, 72 Option, and EuropeFX. These funds are currently on hold, pending further legal proceedings. Encouragingly, part of these frozen assets has already been released to victims, offering a measure of relief to those who suffered substantial financial losses.

Regulatory Response and Legal Actions

The exposure of Financial Compensations, ROI-FX, 72 Option, and EuropeFX has prompted swift and decisive action from regulatory bodies across Europe. Authorities have initiated legal proceedings against the perpetrators, aiming to recover misappropriated funds and provide restitution to victims. The collaborative efforts of financial regulators, law enforcement agencies, and international partners underscore the commitment to maintaining the integrity of financial markets and protecting investors from fraudulent schemes.

Moreover, these cases have highlighted the need for enhanced regulatory frameworks and investor education. Regulators are advocating for stricter oversight of online trading platforms and cryptocurrency exchanges, ensuring that they adhere to transparent and ethical practices. Additionally, educational campaigns are being launched to equip investors with the knowledge and tools to identify and avoid potential scams.

Legal and Cyber Investigation Involvement

The complexity of these fraud cases has necessitated the involvement of numerous law firms and cyber investigation companies. These entities are playing a crucial role in tracing the flow of funds, analyzing digital evidence, and assisting in the legal proceedings against the fraudulent operators. Their expertise is instrumental in unraveling the sophisticated tactics employed by Financial Compensations, ROI-FX, 72 Option, and EuropeFX, and in securing justice for the victims.

Implications for the Financial Market

The downfall of Financial Compensations, ROI-FX, 72 Option, and EuropeFX serves as a stark reminder of the risks associated with online trading and cryptocurrency investments. While these sectors offer immense potential for growth and innovation, they also present opportunities for exploitation by unscrupulous actors. Investors are urged to exercise caution, conduct thorough due diligence, and rely on established and regulated financial institutions when considering investment opportunities.

The ongoing investigations and legal actions against Financial Compensations, ROI-FX, 72 Option, and EuropeFX are expected to result in significant repercussions for those involved in these fraudulent activities. The cases also serve as a catalyst for broader regulatory reforms aimed at safeguarding the interests of investors and ensuring the long-term stability of digital financial markets.

In conclusion, the exposure of Financial Compensations, ROI-FX, 72 Option, and EuropeFX underscores the critical importance of vigilance, transparency, and regulatory oversight in the rapidly evolving landscape of online trading and cryptocurrency. As authorities continue to pursue justice for the victims, the financial community must remain steadfast in its commitment to ethical practices and investor protection.